To grow your business you need more customers. In most cases, customers will not find your product unless you are marketing yourself. You will have to spend money, time, and other resources to promote your company. Understanding Customer Acquisition Cost will help you figure out where best to spend your resources to acquire customers.

What is Customer Acquisition Cost?

Customer Acquisition Cost (CAC) is the total amount spent to getting a new lead, subscriber, or customer. The lower the cost the better, as it indicates a lower cost for each new customer. CAC is the standard by which marketing campaigns are measured.

CAC is a way to measure how hard it is to gain new customers. Most software as a service companies have to do many activities to gain new customers:

- Create awareness

- Explain their benefits

- Provide sales support (customer support during trial, demos, etc)

CAC includes the spending on all of the above bullet points, including awareness, content creation, and sales support. CAC is also known as Acquisition Cost and Cost per Acquisition (CPA).

CAC helps companies know which avenues of marketing and sales are bringing in customers efficiently. A company’s goal is to make the ratio between revenue per user and the cost to acquire them as large as possible.

How to calculate Customer Acquisition Cost

The most straightforward formula for calculating CAC is by dividing the amount spent on acquiring new customers by the number of customers acquired during that period of time.

If you’re not sure of the amount spent on acquiring new customers, you can take a deeper look at spend sources like:

- Cost of ads

- Cost to create advertisements

- Cost to create sales support materials

- Cost of customer support during trial

- Cost of marketing and sales employees

Calculation example

A company spends a total of $300k in sales and marketing and generated 300 new customers during a one year period. We can compute CAC thusly:

The company’s Customer Acquisition Cost is $1k.

The hope is that the CAC is less than the expected revenue per customer so that you will make money with the chosen acquisition strategy.

Best practices for using Customer Acquisition Cost

Customer Acquisition Cost and Lifetime Value

As noted above, we’d like the revenue per user to be greater than the costs required to acquire them. The best way to check the profitability of your business is by calculating the Customer Acquisition Cost and comparing it to a user’s Lifetime Value (LTV). This will tell you whether you’re making a profit, if you’re running on an absolute loss, or if you’re on the neutral edge of survivability.

So if CAC is $1000 per customer and your LTV is $2000, your LTV to CAC ratio is 2:1 which is good but not great.

The ideal ratio is somewhat debated, but is typically agreed on 3:1. If you are lower than this, then you are probably spending too much on your channel. If you are above this ratio, you should spend more in that channel because you are likely missing out on opportunities.

Customer Acquisition Cost returned in 12 months

In addition to checking the overall ratio of LTV to CAC, it’s a good idea to see how long it would take to recover the costs of acquisition. The shorter the time taken to acquire the cost spent on acquiring new customers, the more efficient the business model is. The rule of thumb here is that companies should aim to get the cost spent on acquiring customers back within 12 months.

Target audience

Targeting a select audience makes it easier to win over potential customers. A fertilizer company targeting farmers will have more success than if they targeted everyone in the USA. Targeting will reduce the amount of money spent on impressions and clicks that won’t end up converting to being a customer.

When starting out, spend as low as possible until you’ve determined a target and model for converting people into customers. Spending low gives you the opportunity to test your sales calls and determine if the channel is scalable. Also, as your business grows it can become more expensive to find more customers, so do not be surprised to see CAC increase as the ‘easier’ customers get acquired.

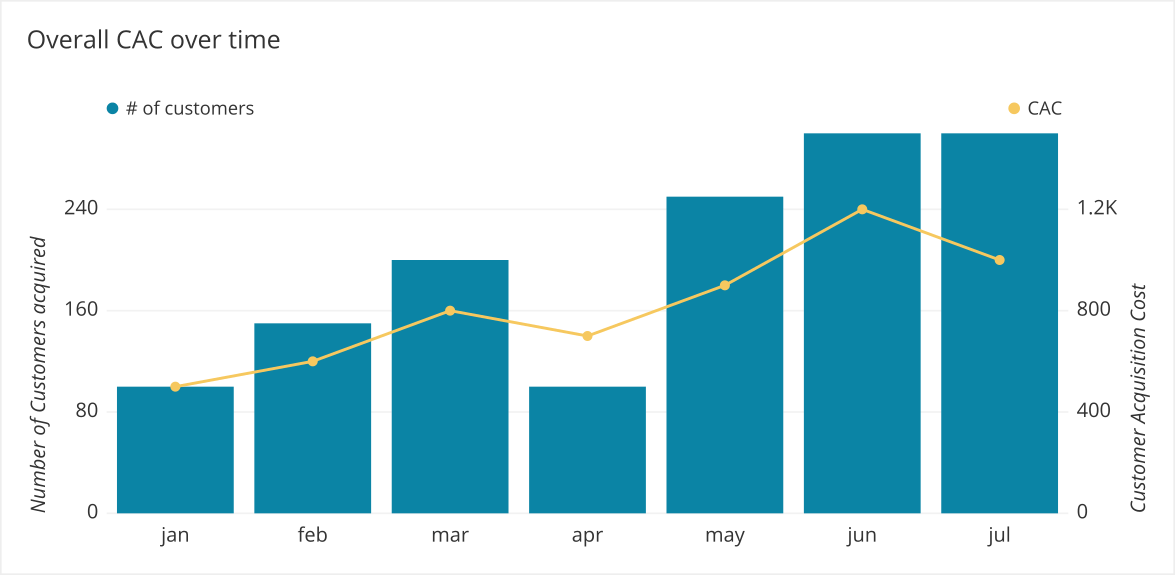

Visualizing Customer Acquisition Cost

Customer Acquisition cost can be visualized in different ways to show aspects of the data.

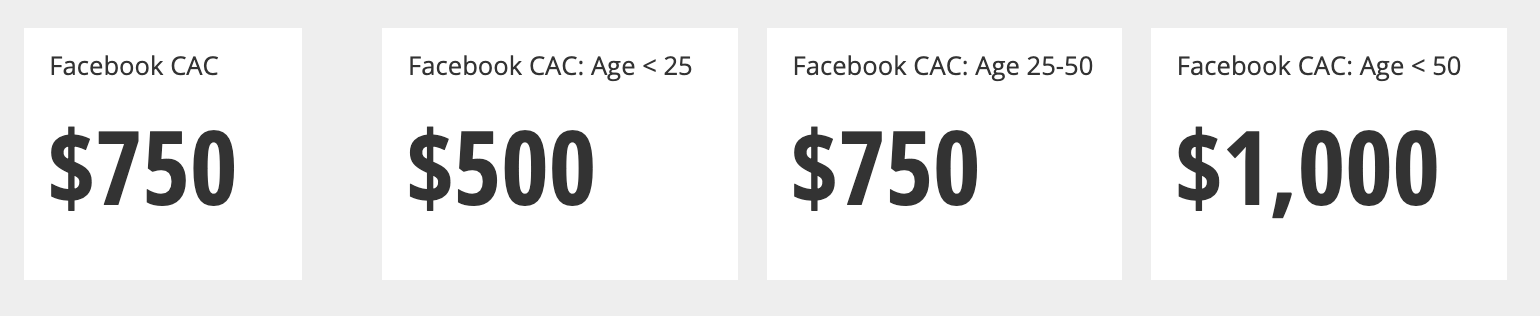

- Single value charts can clearly summarize Customer Acquisition Cost. You could also use these to show CAC by different segments such as channel.

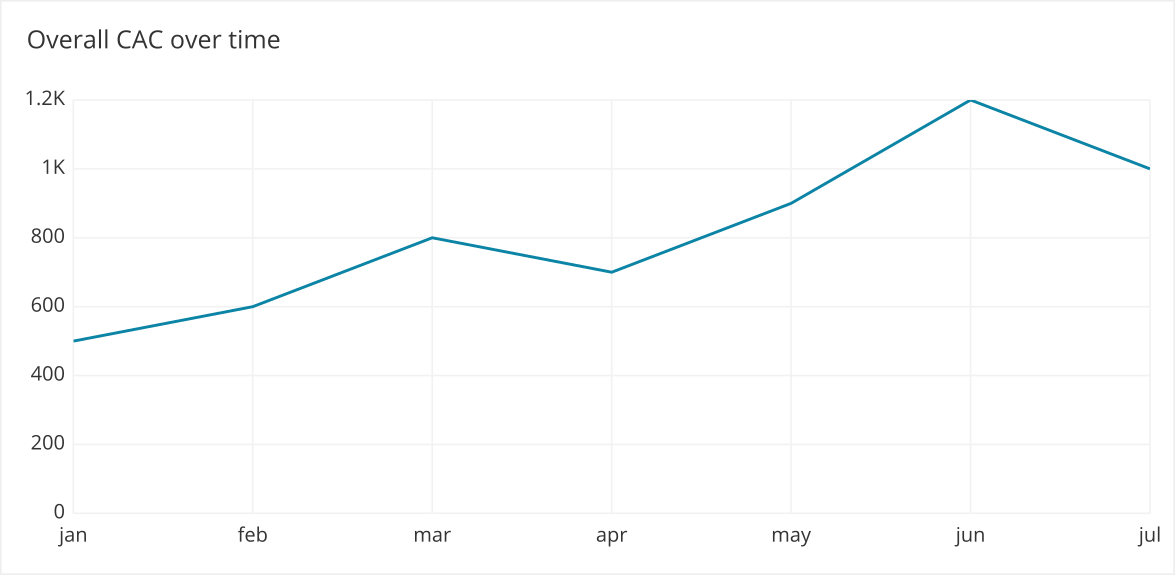

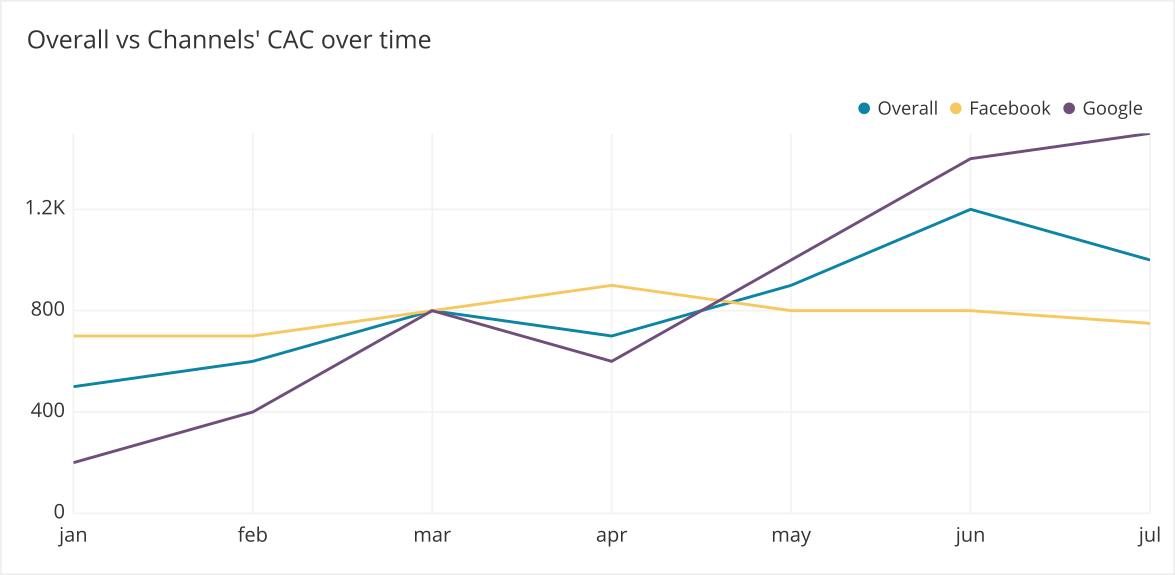

- Line charts can display CAC over time to expose overall trends. We can show how different segments trend as well.

- Bar + line charts can help us understand how both the volume of customers being acquired along with the cost.

The importance of visualizing CAC

Visualizing CAC lets you see what channels are working and what are not. This is important because you have limited marketing resources and deploying them effectively is critical to getting the best ROI.

Common ways to segment CAC

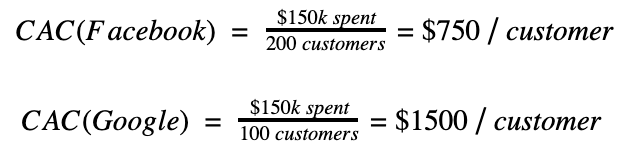

Total CAC can often hide what specific ads/channels are most and least effective. It is common to break out CAC to see where to further spend and optimize.

For instance if we spent half that money on Facebook ads and half on Google and got twice as many customers through Facebook we would want to invest more in Facebook ads.

We might also look at this data over time or segmented further by demographics to see an even clearer picture.

The most common ways to segment CAC include:

- Channel

- Ad

- Company size

- Country

- Age

- User Persona

These segmentations can make it very clear where we are getting the most bang for our buck. Let’s segment the Facebook CAC further, this time dividing by age.

Here, we can see our ads are performing well for people under the age of 25 and very poorly for older groups.

Common misuses

Poor Attribution

You have to set up attribution tracking so that you know what marketing materials your customers engaged with before signing up. If you do not do this properly the data can quickly become useless. Often times people will forget to use a tracking url or the link in the ad is broken for some reason. These small mistakes mean that you cannot learn from that marketing.

Ignoring LTV

After acquiring your customer, you may think you are done. You found a channel that works. Unfortunately there is no guarantee that even after the initial conversion they will meet your expectations for life time value. You need to make sure you are acquiring the right type of customer. This is important to factor in to your LTV to CAC ratio.

Variations on CAC

Blended vs Paid CAC

So far we have touched on both of these. When we talk about CAC across all channels this is blended CAC. When we break it out by marketing channel we are looking at paid CAC (#8 in the list). We highly recommend segmenting your CAC out as granularly as you can to find what is really working and what is a waste of money.

The rise of CAC

The rise of internet-based companies and trackable web-based advertising campaigns has given an enormous rise to this metric because it can be more easily tracked. In the past, companies had to rely on discount codes or surveys to know if their advertising was working. Companies can now leverage tags and cookies to determine where their customers are coming from and correctly attribute what money was spent on channels that produced new customers.